Payroll software is quickly becoming a must-have for businesses in Saudi Arabia, especially as compliance rules get stricter and workforces become more complex.

Handling salaries, deductions, overtime, and benefits manually is a recipe for mistakes and delays, which can erode employee trust and even lead to legal issues.

With regulations like WPS, GOSI, and ZATCA constantly changing, companies really need payroll systems that are accurate, automated, and fully compliant with local laws.

Heading into 2026, Saudi businesses are putting a bigger focus on efficiency and transparency in their HR processes.

Modern payroll software makes life easier by automating calculations, producing compliant reports, and ensuring salaries are paid on time.

It also takes a lot of pressure off HR teams and gives employees a better experience with self-service access to their payslips and records.

In this blog, we’ll look at the 9 best payroll software options in Saudi Arabia, spotlighting the ones that experts are recommending and helping you find the right fit for your local needs and future growth.

Table of contents

What to Look for in Payroll Software for Saudi Businesses?

Choosing payroll software in Saudi Arabia, businesses must pay attention to the tools that meet the domestic regulations and business demands.

The Saudi labor laws, WPS salary protection, GOSI contributions, and ZATCA requirements should be given the priority.

These rules need to be managed by a trusted payroll system to eliminate legal risks and fines.

Accuracy and automation are also important.

Salary, overtime, deductions, and end-of-service benefits should be computed properly and automatically using payroll software rather than manually.

This is an effort to reduce mistakes, and the employees receive their salaries on time each month.

Scalability and integration should also be kept in mind by businesses.

The entry of more companies will require a payroll system capable of accommodating a large number of employees and easily merging with HR, attendance, and accounting systems.

Employee self-service and cloud-based access, along with safe data storage, also enhance efficiency and transparency, and payroll management is easier for both the HR teams and employees.

Top 9 Payroll Software in Saudi Arabia

1. PeoplesHR

PeoplesHR is a comprehensive payroll and HR software available in Saudi Arabia through a strategic partnership with Ensaan Tech.

It is designed to help organizations manage payroll accurately while staying compliant with Saudi regulations such as WPS and GOSI.

The platform centralizes employee data and automates salary calculations, deductions, and statutory contributions.

PeoplesHR also integrates payroll with core HR functions, making it easier for HR teams to manage the full employee lifecycle.

With employee self-service and reporting tools, businesses gain better control, transparency, and efficiency in payroll operations while reducing manual work and errors.

Key Features

- Automated payroll processing with accurate salary, deduction, and allowance calculations

- Compliance with Saudi regulations including WPS, GOSI, and local labor laws

- Centralized employee database for payroll and HR information

- Integration of payroll with core HR modules for hire-to-retire management

- Employee self-service access for payslips, leave, and personal details

- Customizable payroll reports for audits and management review

- Secure data handling with role-based access controls

2. Adrenalin Payroll

Adrenalin Payroll is a robust payroll software built to handle complex payroll needs for Saudi businesses.

It automates salary calculations, deductions, and payments while ensuring compliance with Saudi labor laws and WPS requirements.

Key Features

- Automated end-to-end payroll processing

- Compliance with Saudi labor law and WPS regulations

- Integrated HR, attendance, and leave data

- Employee self-service for payslips and salary details

- Multi-entity and multi-location payroll support

3. SAP SuccessFactors Payroll

SAP SuccessFactors Payroll supports large organizations with structured payroll processing and strong integration with enterprise HR systems.

It helps manage salary calculations, deductions, and payroll reporting across complex organizational structures.

The platform is suitable for companies that already use SAP products and require standardized payroll workflows, centralized data handling, and consistent payroll execution across departments and locations.

4. Bayzat Payroll

Bayzat Payroll focuses on combining payroll with employee benefits and HR administration.

It helps businesses manage salary processing while keeping employee records organized.

The platform is commonly used by growing companies looking for a unified system to handle payroll and basic HR functions.

Bayzat offers visibility into payroll data and supports smoother coordination between HR and finance teams.

5. ZenHR Payroll

ZenHR Payroll is built for businesses operating in the Middle East, offering payroll features aligned with regional labor practices.

It supports payroll calculations, employee records, and HR workflows in a single platform.

The system is often used by organizations seeking localized HR and payroll management without complex enterprise-level infrastructure.

6. BambooHR Payroll

BambooHR Payroll is designed to work alongside BambooHR’s core HR system, focusing on simple payroll processing for small and medium businesses.

It helps manage salaries, deductions, and employee payroll data with minimal setup.

The platform is suitable for organizations that want payroll tightly connected to employee information and HR processes.

7. SmartHCM Payroll

SmartHCM Payroll provides payroll and workforce management tools for organizations with diverse employee structures.

It supports payroll processing, attendance integration, and HR data management.

The system is commonly used by companies that require flexible payroll configurations and integration with broader HR operations across departments.

8. Idaratech Payroll

Idaratech Payroll offers payroll and HR solutions tailored for regional business needs.

It helps manage payroll records, salary processing, and employee data within a single system.

The platform is used by organizations looking for a locally developed payroll solution that supports basic HR and payroll operations without heavy customization.

9. Zoho Payroll

Zoho Payroll is a cloud-based payroll solution designed for small to mid-sized businesses.

It supports salary processing, payslip generation, and basic compliance needs.

The platform integrates with other Zoho applications, making it suitable for organizations already using the Zoho ecosystem.

It’s simple interface allows HR teams to manage payroll tasks efficiently without extensive technical setup.

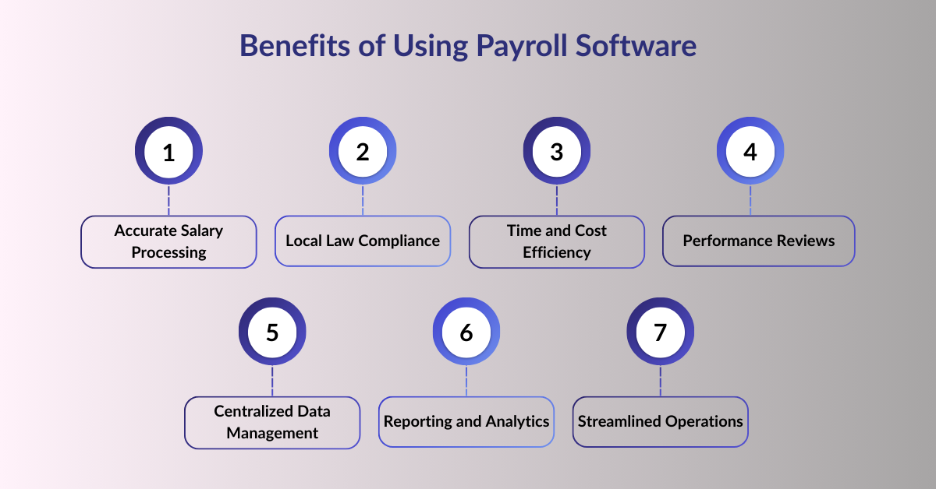

Benefits of Using Payroll Software in Saudi Arabia

- Accurate Salary Processing: Payroll software ensures precise calculation of salaries, overtime, allowances, and deductions, reducing errors and avoiding delays.

- Compliance with Local Laws: It helps organizations comply with Saudi labor laws, WPS requirements, and statutory deductions, minimizing legal risks.

- Time and Cost Efficiency: Automation of repetitive payroll tasks frees HR teams and reduces administrative overhead.

- Employee Self-Service: Staff can access payslips, leave balances, and payroll records easily, improving transparency and satisfaction.

- Centralized Data Management: Payroll and HR information is stored in one platform for easy access and management.

- Reporting and Analytics: Provides insights into workforce planning, budgeting, and decision-making.

- Streamlined Operations: Integration with HR, attendance, and performance systems creates smooth workflows and improves overall efficiency.

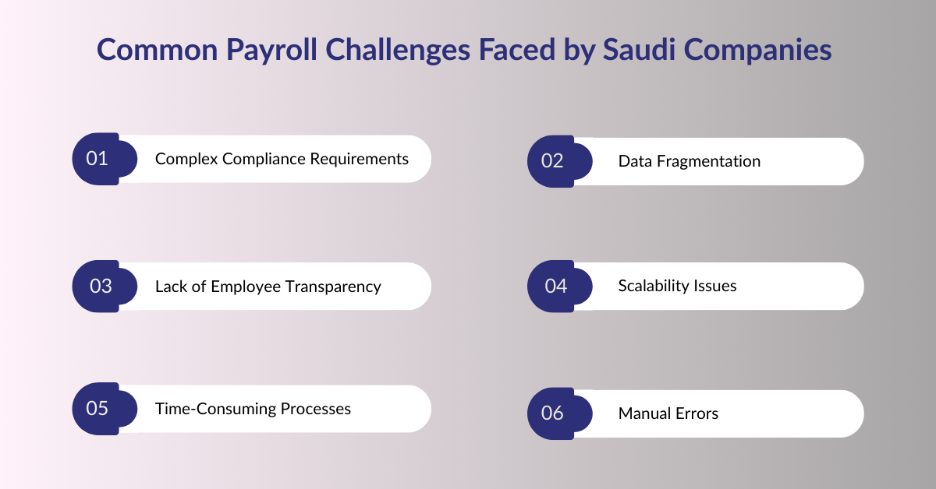

Common Payroll Challenges Faced by Saudi Companies

- Complex Compliance Requirements: Saudi labor laws, WPS regulations, and GOSI contributions make payroll compliance challenging for HR teams.

- Manual Errors: Processing payroll manually increases the risk of mistakes in salaries, deductions, and end-of-service benefits.

- Time-Consuming Processes: Traditional payroll methods consume significant HR time, reducing focus on strategic initiatives.

- Data Fragmentation: Payroll and HR data stored in separate systems can lead to inconsistencies and inefficiencies.

- Scalability Issues: Growing organizations often struggle to manage payroll for an increasing number of employees across multiple locations.

- Lack of Employee Transparency: Without self-service portals, employees may face delays in accessing payslips or salary information.

How Does Ensaan Technologies Help Businesses Implement the Right Payroll Solution?

- Detailed Needs Assessment: Ensaan Tech evaluates an organization’s payroll requirements, workforce size, and compliance needs to recommend the most suitable software.

- Platform Comparison: The team compares multiple payroll solutions based on features, scalability, and integration capabilities to find the best fit.

- Seamless Implementation: Ensaan Tech provides full support during software setup, configuration, and integration, ensuring minimal disruption to HR operations.

- Compliance Guidance: They ensure the payroll system aligns with Saudi labor laws, WPS, and statutory requirements.

- Employee Training: Ensaan Tech trains HR teams and staff to use the software effectively, improving adoption and efficiency.

- Ongoing Support: Continuous technical assistance and updates maintain smooth payroll operations.

- Future-Ready Solutions: Ensaan Tech helps businesses select scalable payroll systems that can grow with the organization and adapt to evolving needs.

Conclusion

Choosing the right payroll software is crucial for businesses in Saudi Arabia to keep everything accurate, compliant, and running smoothly in 2026 and beyond.

A good system helps cut down on mistakes, automates those repetitive tasks, and makes sure salaries are paid on time, all while staying fully compliant with WPS, GOSI, and local labor laws.

Working with Ensaan Tech makes the whole process easier: we help you find the perfect payroll solution for your needs, implement it without any headaches, and train your team so everyone gets up to speed quickly.

Today’s payroll tools also come with handy features like centralized data storage, employee self-service portals, and powerful reporting options that give you better insights for decision-making and workforce planning.

When you pick up a scalable platform that integrates well with your other systems, you’ll streamline your operations, save valuable time, and boost employee satisfaction along the way.

Ensaan Tech is here to support you for the long journey, guiding you toward solutions that are compliant, efficient, and flexible enough to grow with your business and adapt to any future changes in payroll requirements.

FAQs

Payroll software ensures accurate salary calculations and compliance with Saudi labor laws and reduces HR administrative work.

Yes, most payroll solutions can integrate with HR, attendance, and accounting systems for seamless operations.

Employees can quickly access payslips, leave balances, and salary information through self-service portals.

Ensaan Tech guides businesses in choosing the right software, supports setup, provides training, and ensures smooth operation.

Yes, modern payroll software is scalable and can handle an increasing number of employees and locations.

Yes, it ensures that payroll processes meet Saudi labor laws, WPS, and statutory regulations.

Absolutely, automation minimizes manual errors and ensures accurate and timely payments.