Payroll plays an essential role in keeping employees satisfied, adhering to regulations and running an organization smoothly.

Payroll in the United Arab Emirates (UAE) is especially critical due to stringent labor laws and the Wage Protection System established by the Ministry of Human Resources and Emiratisation (MOHRE).

Payroll management ensures employees are paid on time and fairly. But for businesses both big and small, taking the right steps when handling payroll can be complex.

PeoplesHR intelligent HR software can make an enormous difference.

This blog will clearly outline how payroll works in the UAE, its steps and how PeoplesHR helps businesses manage payroll more easily through automation, accuracy, and legal compliance.

Table of contents

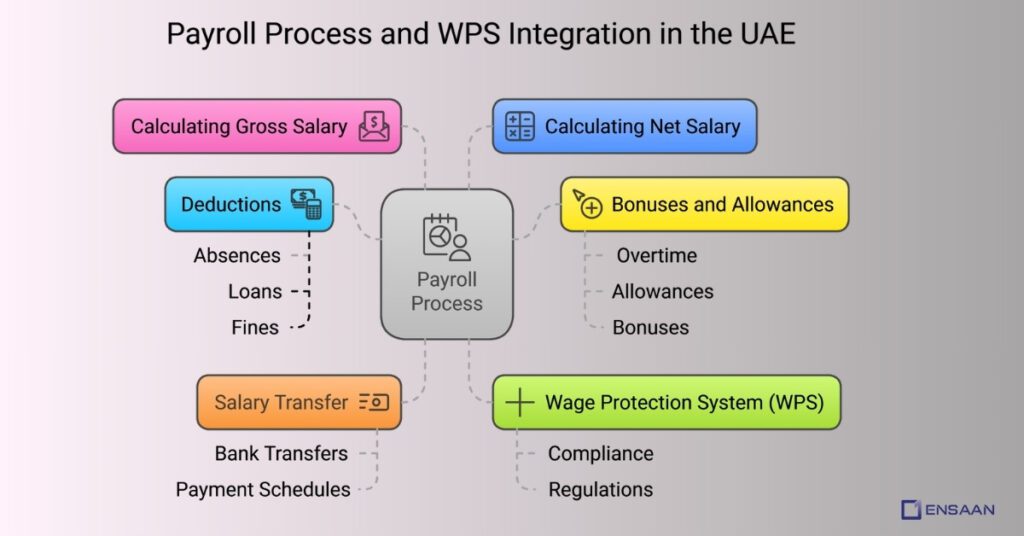

What is Payroll?

Payroll is the process of calculating and distributing salaries to employees.

It includes:

- Calculating gross salary

- Deductions (like absences, loans, fines)

- Bonuses, allowances, and overtime

- Calculating the net salary

- Transferring salaries to employee bank accounts

In the UAE, payroll processing is closely interlinked with Wage Protection System (WPS), which is required of most private sector companies.

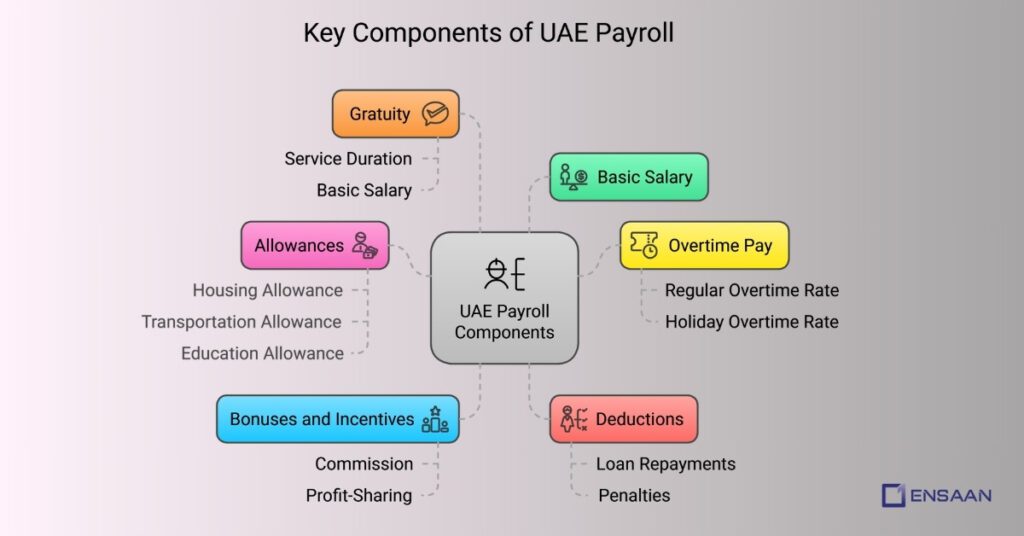

Key Components of UAE Payroll

To effectively manage payroll in the UAE, HR professionals need to understand the components that typically make up an employee’s salary package.

While the exact structure may vary across companies and industries, most payrolls in the UAE include the following elements:

1. Basic Salary:

The base salary is the fixed amount that an employee is entitled to receive every month.

This figure is usually specified in the employment contract and serves as the foundation for calculating other benefits such as the end-of-service gratuity.

2. Allowances:

Allowances are additional monetary benefits provided by the employer.

Common allowances in the UAE include housing allowance, transportation allowance, mobile or internet reimbursement, and food or travel allowances.

Some employers also offer education allowances for employees with children.

3. Overtime Pay:

Employees working beyond their regular hours are legally entitled to overtime compensation.

The UAE Labour Law mandates that overtime should be paid at a rate of 125% of the regular hourly wage and 150% if the overtime falls during public holidays or night shifts.

4. Bonuses and Incentives:

Performance-based bonuses, commission, or profit-sharing incentives may be part of the salary structure depending on the role and industry.

5. Deductions:

Deductions can include loan repayments, absences without leave, penalties (if justifiable), or advances taken by the employee.

It is important that all deductions are documented and legally compliant.

6. Gratuity (End-of-Service Benefits):

Under UAE law, employees are entitled to gratuity payments when they resign or are terminated, provided they have completed at least one year of service.

The calculation is typically based on the basic salary and the number of years worked.

By using PeoplesHR, companies can automate these calculations and reduce the chances of human error.

The platform allows for customizable salary structures, handles complex calculations for overtime and bonuses, and ensures everything is accurately processed.

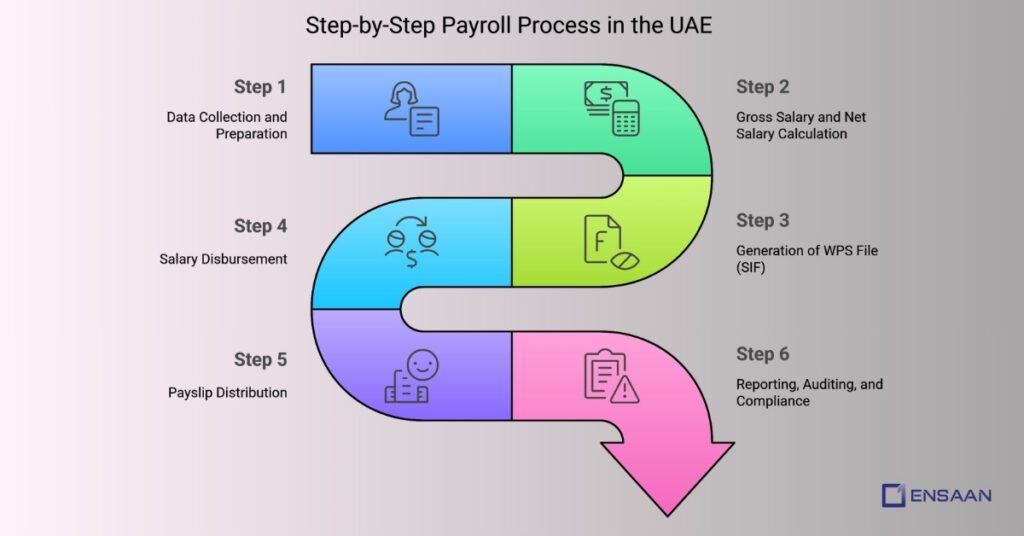

Step-by-Step Payroll Process in the UAE

Let’s now walk through the entire payroll process step-by-step, with a focus on how PeoplesHR optimizes each stage to save time, reduce errors, and ensure compliance.

Step 1: Data Collection and Preparation

The first step in payroll processing is collecting relevant employee information. This includes basic salary details, allowances, deductions, attendance data, leave records, and any other variable pay elements like commissions or bonuses. This stage requires precise tracking, especially for companies with large teams or complex shift schedules.

Manual data entry can lead to significant errors and inconsistencies. That’s why PeoplesHR offers an integrated HR module that captures attendance, leave, and performance data in real-time.

This eliminates the need for cross-verifying multiple spreadsheets, ensuring payroll is always based on the most up-to-date information.

Step 2: Gross Salary and Net Salary Calculation

Once all necessary data is collected, HR must calculate the gross salary (basic + allowances + other earnings) and then subtract the necessary deductions to arrive at the net salary.

Calculations must also consider prorated salaries for employees who joined or resigned mid-month, unpaid leaves, or adjustments for business advances.

With PeoplesHR, all these computations are handled automatically. The system applies business rules based on the employee profile, work schedule, and attendance data to calculate accurate salaries. This not only speeds up the process but also helps ensure legal compliance.

Step 3: Generation of WPS File (SIF)

The Wage Protection System (WPS) requires employers to submit a specific file known as the Salary Information File (SIF).

This file must include employee details such as full name, Emirates ID, labor card number, bank account or payroll card number, and salary components.

Creating this file manually can be cumbersome and error prone. PeoplesHR streamlines this by automatically generating WPS-compliant SIF files based on the monthly payroll data.

With just a click, HR can download the file and submit it to their bank or exchange house, ensuring zero compliance errors.

Step 4: Salary Disbursement

Once the SIF is submitted and approved, the bank transfers the salaries to employee accounts.

Employers must ensure that this step is completed within the regulated time frame to avoid penalties or sanctions from MOHRE.

PeoplesHR provides real-time tracking of salary disbursements. If there are issues with processing or payment failures, the system sends alerts so HR can act quickly and avoid regulatory trouble.

Step 5: Payslip Distribution

Under UAE labor laws, employees are entitled to receive payslips with a detailed breakdown of earnings and deductions.

This transparency builds trust and helps employees understand their compensation structure.

PeoplesHR offers an Employee Self-Service (ESS) Portal, where employees can securely log in, view, and download their payslips at any time.

This reduces the administrative burden on HR and empowers employees with real-time access to their salary records.

Step 6: Reporting, Auditing, and Compliance

Once salaries are processed, HR must generate payroll reports for internal use, auditing, and compliance.

These reports may include monthly payroll summaries, cost breakdowns by department, WPS compliance logs, or gratuity provisions.

PeoplesHR reporting module allows HR teams to generate detailed reports in just a few clicks.

The platform also supports data visualization, trend analysis, and forecasting making it easier for decision-makers to manage budgets, plan resources, and ensure ongoing compliance.

What are Legal Considerations in UAE Payroll?

One of the biggest risks in payroll management is non-compliance with labor laws. In the UAE, companies are legally obligated to:

- Pay salaries by the end of each month or within 10 days of the due date

- Use WPS for salary transfers

- Provide payslips to employees

- Maintain payroll records for at least two years

- Properly calculate and disburse end-of-service gratuity

Non-compliance can lead to serious consequences, such as:

- Fines up to AED 50,000 per offense

- Suspension of work permits

- Legal action by employees

- Negative brand reputation

PeoplesHR is built with compliance in mind. From audit trails to data validation checks, the system ensures that companies adhere to UAE labor laws.

Regular software updates also keep the system aligned with any changes in local regulations.

Benefits of Using PeoplesHR for Payroll in the UAE

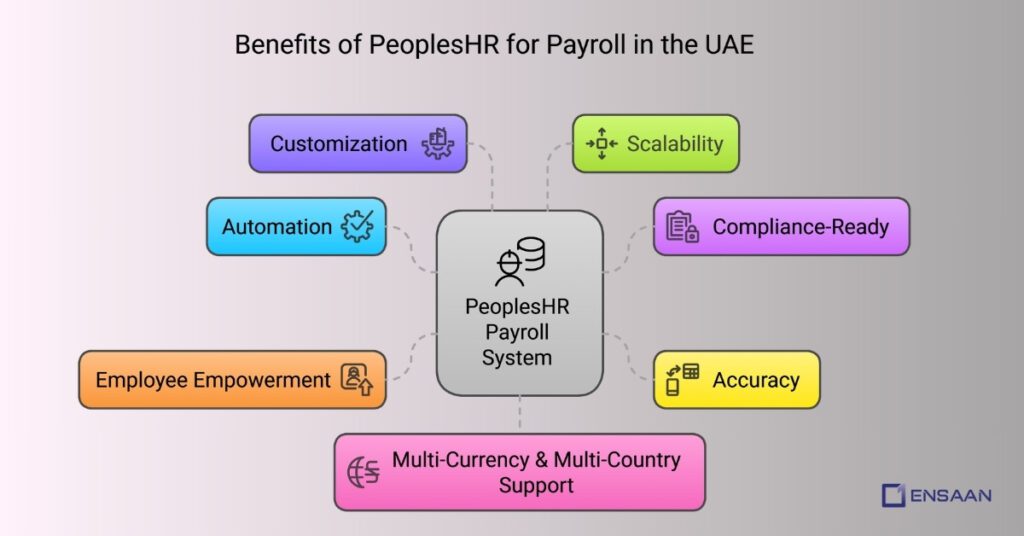

Let’s look at some of the specific advantages PeoplesHR brings to the payroll process:

- Automation: Saves time by eliminating manual data entry and calculations.

- Compliance-Ready: Generates WPS files and keeps up with legal changes.

- Accuracy: Reduces human error by integrating real-time employee data.

- Employee Empowerment: Through the ESS portal, employees can access their information anytime.

- Customization: Can be tailored to match company-specific salary structures, shifts, and allowances.

- Scalability: Works just as well for SMEs as it does for large enterprises with thousands of employees.

- Multi-Currency and Multi-Country Support: Ideal for companies with branches in other countries.

Types of Payroll Reports Available in PeoplesHR

Payroll isn’t just about making payments. It also provides valuable insights into business operations.

PeoplesHR helps companies gain deeper understanding with powerful reporting features, such as:

- Department-wise Payroll Summary

- Monthly Payroll Comparison

- WPS Audit Reports

- Overtime and Allowance Trends

- Gratuity Provision Reports

- Payroll Budget vs. Actual Analysis

These reports support strategic decision-making, help control costs and ensure transparency across departments.

Best Practices for Payroll Management in the UAE

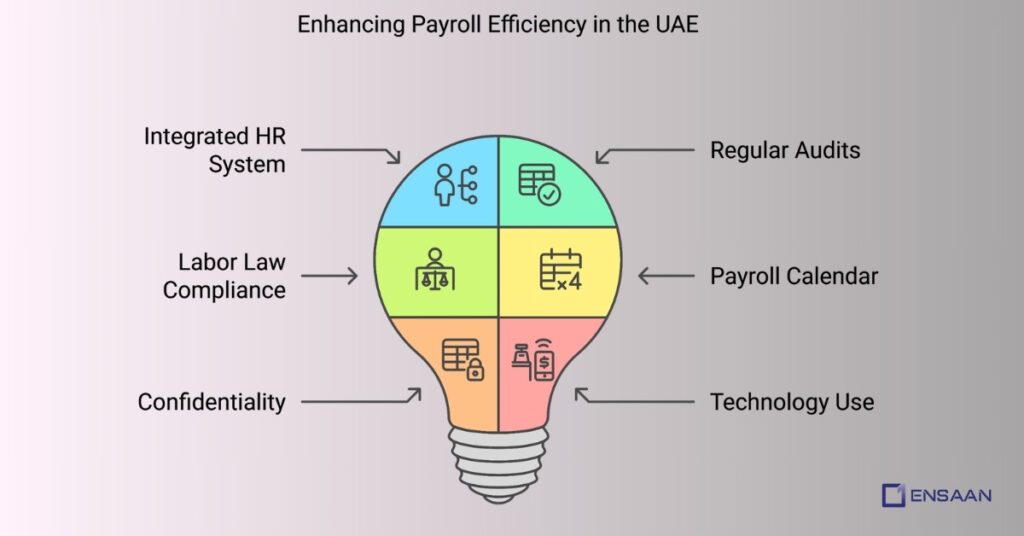

To make payroll more efficient and error-free, companies should adopt the following best practices:

- Implement an Integrated HR System: A centralized system like PeoplesHR streamlines every aspect of payroll.

- Audit Payroll Data Regularly: Regular checks help identify discrepancies early and prevent larger issues.

- Stay Updated on Labor Laws: Compliance isn’t optional. Ensure your HR team receives regular training.

- Create a Payroll Calendar: Plan each month’s payroll cycle in advance to avoid delays.

- Ensure Confidentiality: Salary information is sensitive and must be handled securely.

- Use Technology to Your Advantage: Automate processes, generate digital payslips, and leverage analytics.

Conclusion

Payroll in the UAE is a critical task that must follow strict labor laws and the Wage Protection System (WPS).

Mistakes can lead to fines, legal issues, and unhappy employees. PeoplesHR makes payroll easy by automating salary calculations, WPS file generation, and reporting.

It reduces manual work, ensures compliance, and gives both HR and employees a smooth, stress-free payroll experience.

Whether you’re a small business or a large company, PeoplesHR is a smart way to keep payroll accurate and future ready.

FAQ

WPS is an electronic salary transfer system in the UAE that ensures employees are paid on time through banks or exchange houses approved by the Central Bank.

Yes, all private-sector companies registered with MOHRE must process salaries through WPS.

Payroll includes basic salary, allowances, bonuses, overtime, and deductions like unpaid leave or loans.

Gratuity is based on the employee’s basic salary and years of service. Full-time employees must have at least one year of service to qualify.

Salaries should be paid by the end of the month or within 10 days from the due date as per labor law.

Penalties may include fines, suspension of new work permits, or blacklisting by MOHRE.

Yes! HR software like PeoplesHR automates salary calculations, WPS file generation, payslip distribution, and reporting.

It’s a file used to submit salary details to the WPS. It includes employee and salary information in a specific format.

Yes, employees are entitled to receive a breakdown of their salary in the form of a payslip.

PeoplesHR automates the entire payroll process, ensures WPS compliance, reduces errors, and improves transparency through real-time reporting and employee self-service access.